A well-defined expense reimbursement policy is essential for maintaining a healthy employee-employer relationship, as delays in reimbursement can signal that the company does not value its staff’s time, money, or effort. Best practices demonstrate that clear, enforceable policies reduce reimbursement cycles, prevent errors, and foster trust among employees.

Additionally, automating and refining reimbursement policy enforcement can result in an average 23% decrease in business travel and expense costs. This article explains what makes a good expense reimbursement policy, as well as best practices for implementation. It also provides a free customizable template to help you improve your organization’s policy.

Contents

What is an expense reimbursement policy?

What HR should know about expense reimbursement

What to include in an expense reimbursement policy

Free expense reimbursement policy template

Expense reimbursement policy: 11 best practices for HR

Key takeaways

- A clear, enforceable expense reimbursement policy is essential to protect against fraud, support financial control, and maintain a positive employee experience.

- HR must design and manage a fair, compliant policy that defines eligible expenses, documentation standards, timelines, and roles.

- The policy must also account for differing tax and labor laws across relevant jurisdictions.

- Following best practices improves compliance, efficiency, and trust — AIHR’s free template helps organizations put this into practice.

What is an expense reimbursement policy?

An expense reimbursement policy is a written set of rules explaining which business expenses employees can claim and how the company will reimburse them. It defines what the company considers legitimate business costs, sets limits and documentation requirements, and dictates timelines for submitting and approving claims.

This gives employees clear guidance on the reimbursement process and helps the organization manage and track expenses consistently. A clear reimbursement policy is vital for financial control and HR compliance. It keeps business spending consistent across the company, makes clear what is and isn’t allowed, and prevents disputes or delays in repayment.

Without a defined policy, organizations risk inconsistent approvals, delayed payments, frustrated employees, and potential tax or audit issues due to poorly tracked expenses. A solid policy protects both the company and its people by supporting fairness, accountability and compliance.

What HR should know about expense reimbursement

HR plays a central role in developing and managing a clear, fair, and compliant expense reimbursement policy. Employers are usually legally required to reimburse employees for necessary work-related expenses, so the policy must clearly define which expenses qualify, how to claim them, and when reimbursement will occur.

As part of the HR team, you must ensure the policy specifies covered costs (e.g., travel, equipment, or client meals) and the required documentation for approval. A well-structured policy ensures employees don’t have to bear legitimate business costs out of pocket, which can cause dissatisfaction and create legal risk.

As reimbursement rules vary among states and jurisdictions, it’s essential to stay informed about relevant local laws. Some regions, for example, specify repayment timelines or define what counts as a reimbursable expense. You must also understand the applicable tax regulations — for instance, reimbursements are typically non-taxable for employees.

Maintaining a compliant and transparent reimbursement policy supports operational efficiency, protects employee trust, and ensures regulatory integrity.

Master policy development and other key skills for HR success

Obtain crucial skills in policy development and implementation, employee life cycle management and HR administration to become a more well-rounded, efficient HR professional.

AIHR’s HR Coordinator Certificate Program will help you to:

✅ Craft, implement and maintain HR policies that support business needs

✅ Master Human Resources fundamentals across the entire employee lifecycle

✅ Take decisive, independent action in handling HR administration responsibilities

What to include in an expense reimbursement policy

Here’s what to include in your organization’s expense reimbursement policy:

Policy statement

This outlines the purpose of the policy, i.e., explaining how employees can claim repayment for reasonable, legitimate business expenses incurred while carrying out company duties, and what qualifies as a claimable expense.

The policy statement should emphasize fair, efficient, and compliant expense approval. It should also highlight that the company will reimburse only business-related costs that are properly documented, approved, and submitted through the correct process.

Scope

The scope refers to what the policy covers. In this case, it should apply to all employees, contractors, and consultants authorized to incur work-related expenses on behalf of the company.

This typically includes travel, accommodation, meals, learning and development (L&D), client entertainment, work equipment, and other business expenses approved by management. The policy would not cover personal costs or non-business purchases.

Definitions

This section defines the relevant items for expense reimbursement, including what the company considers reimbursable and non-reimbursable expenses, the types of receipts it accepts, and the submission deadlines for employee claims.

A reimbursable expense, for instance, would be a necessary and reasonable cost directly related to business activities. A non-reimbursable expense, on the other hand, refers to any expense of a personal nature or unrelated to company business.

This section would also explain that each submitted receipt must clearly display the supplier, date of purchase, item/service description, and purchase amount. Additionally, it should specify the timeframe for submitting a claim (e.g., within 15 business days of the expense being incurred).

Eligibility and pre-approval

The policy must define what a claim needs to cover in order for the company to approve it. For instance, the organization may allow employees to claim reimbursement only for expenses their managers have pre-approved. In such cases, employees would be required to submit their expenses using the company’s official expense reimbursement form.

This section may also include other rules regarding expense approval, such as expenses above $500 requiring advanced written approval from both the relevant manager and the finance department. Managers are responsible for confirming that claimed expenses align with policy rules before submitting them to finance for review.

Reimbursement procedure

It’s also important to detail the steps of the reimbursement procedure, so everyone has a clear understanding of what they need to do when filing expense claims. For instance, they might first have to complete the expense reimbursement form and attach the corresponding receipts before submitting it to their line manager for review and approval.

Once the manager approves it, they forward the form to finance for processing. Finance then notifies both the manager and employee that they’ve received the form and will reimburse the employee within 10 business days.

In cases where the employee has lost the receipt or was not provided with one, they may have to complete a missing receipt declaration, confirming that they’ve made all reasonable efforts to obtain a copy and that they won’t claim the expense elsewhere.

Responsibilities

This section details who is responsible for what in the reimbursement process. Employees must ensure their claims are accurate, complete, and submitted on time, along with proper documentation. Managers, on the other hand, must verify that all claims meet the reimbursement policy requirements and fall within budget.

HR must maintain and communicate this policy, provide guidance on compliance, and oversee the escalation of disputed claims. Meanwhile, finance must process approved claims, retain and sort appropriate documentation for auditing, and monitor adherence to legal and tax obligations.

Timelines and escalation

Employees must know what to do if a reimbursement claim is delayed, disputed, or denied; this section offers a detailed explanation. For instance, in such an event, the employee should first contact their line manager for clarification.

If unresolved, they may escalate the matter to HR within five business days. HR will review the claim together with finance, then determine a resolution and communicate it to the employee within 10 business days.

Acknowledgements and declarations

This section contains the names and signatures of the employee submitting the claim, the approving party (typically their direct supervisor/line manager), the employee’s department, and how much they’re claiming.

There should also be a signed statement of declaration if no receipt is available. This shows that the employee has disclosed this information and will not claim reimbursement from any other source.

Free expense reimbursement policy template

AIHR has developed a free, customizable expense reimbursement policy template to suit your organization’s operations, approval structure, and compliance requirements. It provides a practical framework for helping you establish a transparent and well-managed company reimbursement policy that ensures employees receive fair and timely reimbursement.

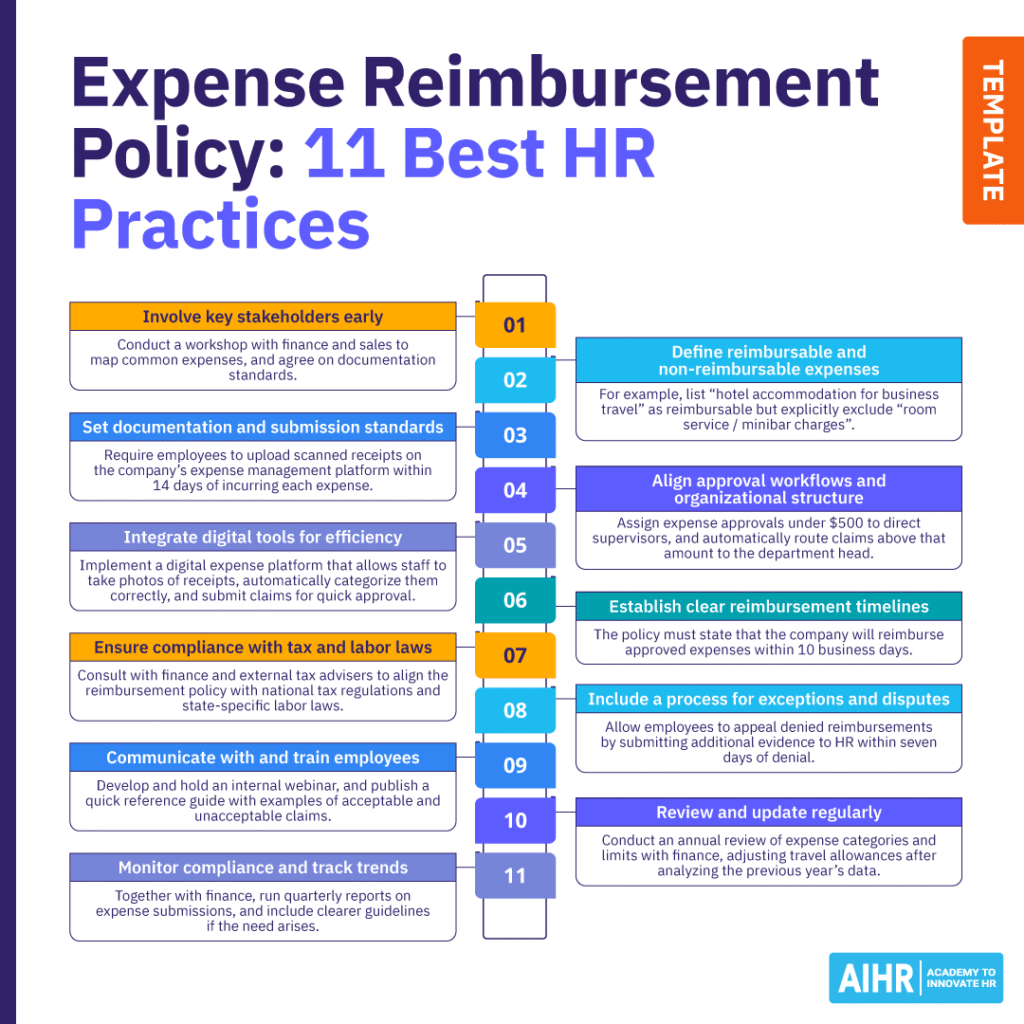

Expense reimbursement policy: 11 best practices for HR

Creating a detailed expense reimbursement policy is only the first step. To make it work in practice, you must help people become familiar with it and incorporate it into their daily operations. Here are 11 best practices to help you design, implement, and manage a clear, consistent, and compliant company reimbursement policy.

1. Involve key stakeholders early

The policy should reflect how the entire organization operates, not just HR’s perspective. Finance, operations, and department heads can advise you on common expenses, approval workflows, and cost control needs. Collaborate with them from the start to align the policy with both business realities and employee expectations.

In action: Conduct a workshop with finance and sales to map common expense types, and agree on documentation standards before finalizing the policy draft.

2. Define reimbursable and non-reimbursable expenses

Ambiguity leads to confusion, delays, and inconsistencies. A well-designed reimbursement policy must explicitly list which expenses qualify for reimbursement and which do not. This clarity reduces administrative effort and helps employees make spending decisions more confidently.

In action: For example, list “hotel accommodation for business travel” as reimbursable but explicitly exclude “room service/minibar charges” to help ensure consistent application across the board.

3. Set documentation and submission standards

Proper documentation supports compliance and accountability. Specify the type of proof of payment the company requires — such as itemized receipts, invoices, or mileage logs — and establish submission deadlines to facilitate accurate record-keeping and simplify audits.

In action: Require employees to upload scanned receipts on the company’s expense management platform within 14 days of incurring each expense. The platform should also automatically scan for and flag missing documentation.

4. Align approval workflows and organizational structure

A reimbursement process should mirror how the business makes decisions. You must define who approves which expenses, and at what thresholds, to control the process and drive efficiency. This prevents bottlenecks and limits senior managers’ review scope to higher-value claims.

In action: Assign expense approvals under $500 to direct supervisors, and automatically route claims above that amount to the relevant department heads.

5. Integrate digital tools for efficiency

Manual expense tracking is prone to delays and errors. An expense management system streamlines submission, approval, and tracking processes, while reducing the administrative burden on HR and finance.

In action: Implement a digital expense platform that allows staff to take photos of receipts, automatically categorize them correctly, and submit claims for quick approval.

6. Establish clear reimbursement timelines

Employees rely on timely reimbursement, and uncertainty erodes trust. It’s therefore important for the reimbursement policy to set clear timeframes for when approved claims will be paid, helping finance teams plan and employees manage their cash flow.

In action: The company reimbursement policy states that approved expenses will be reimbursed within 10 business days via the next payroll cycle.

7. Ensure compliance with tax and labor laws

Tax treatment and reimbursement obligations vary across jurisdictions. As such, you should verify that the policy complies with local laws, including rules that determine when reimbursements can be considered non-taxable income.

In action: Consult with finance and external tax advisers to align the reimbursement policy with national tax regulations and state-specific labor laws.

8. Include a process for exceptions and disputes

Even well-designed policies may encounter grey areas. A clear escalation process for exceptions or disputed claims helps maintain transparency and prevents issues from compounding unnecessarily.

In action: Allow employees to appeal denied reimbursements by submitting additional evidence to HR within seven days of denial, ensuring fair and consistent resolution.

9. Communicate with and train employees

A reimbursement policy only works when employees understand it. As an HR professional, it’s up to you to make the policy easily accessible. You should be able to explain the rationale behind the policy’s rules and train managers to apply it consistently.

In action: Develop and hold an internal webinar, and publish a quick reference guide with examples of acceptable and unacceptable claims to help everyone follow the same process.

10. Review and update regularly

Expenses will evolve as business operations change. Regularly review the reimbursement policy to ensure it remains current with new technologies, evolving travel patterns, business changes, and relevant legal updates.

In action: Conduct an annual review of expense categories and limits with finance, adjusting travel allowances and other reimbursable expenses after analyzing the previous year’s data.

11. Monitor compliance and track trends

Monitor policy compliance through regular audits and data reviews, and closely track trends in expense claims. This will help you identify potential misuse, recurring exceptions, or opportunities to refine expense categories.

In action: Together with finance, run quarterly reports on expense submissions, and include clearer guidelines if the need arises. For instance, if you notice an increase in claims for home office equipment, you may need to update existing guidelines on hybrid work reimbursements.

To sum up

A well-designed expense reimbursement policy helps shape the employee experience. Timely and accurate reimbursements, supported by clear rules, give people a sense of security and assurance. Building a fair, transparent reimbursement system isn’t just administrative housekeeping — it’s an investment in trust, retention, and long-term engagement.

In other words, clarity drives confidence. A clear, detailed policy reduces stress for the entire workforce and helps HR, managers, and finance work from the same playbook. Use the free template provided with this article to help you create a policy that suits your organization and supports the people who keep it running.