Payroll Specialists are key to ensuring correct salary payment, accurate payroll records, and legal and policy compliance. Yet, errors are common — Ernst & Young found U.S. companies average just 80.15% payroll accuracy, meaning one in five payrolls contain mistakes. In the UK, over 90% of businesses admit to monthly payroll errors, costing as much as £150,000 annually.

These statistics show why skilled Payroll Specialists are essential. They combine technical expertise and soft skills to oversee payroll processes, resolve issues, and build trust across the organization. This article discusses their role, what qualifications they need, and how their careers can progress.

Contents

What is a Payroll Specialist?

Payroll Specialist job description

Roles and responsibilities of a Payroll Specialist

Qualifications for a Payroll Specialist role

Skills and competencies for a Payroll Specialist role

Average Payroll Specialist salary

AIHR certificate programs to take

Career paths for a Payroll Specialist

What is a Payroll Specialist?

A Payroll Specialist manages all steps required to ensure employees are paid accurately and punctually. They handle payroll processing, calculate benefits and deductions, and maintain compliant tax and payroll records. Their responsibilities also include conducting audits, reconciling discrepancies, and updating systems in line with policy changes.

They often serve as the first point of contact for employees with pay questions. By handling routine and administrative payroll tasks, they free Payroll Managers to focus on more complex responsibilities such as policy development.

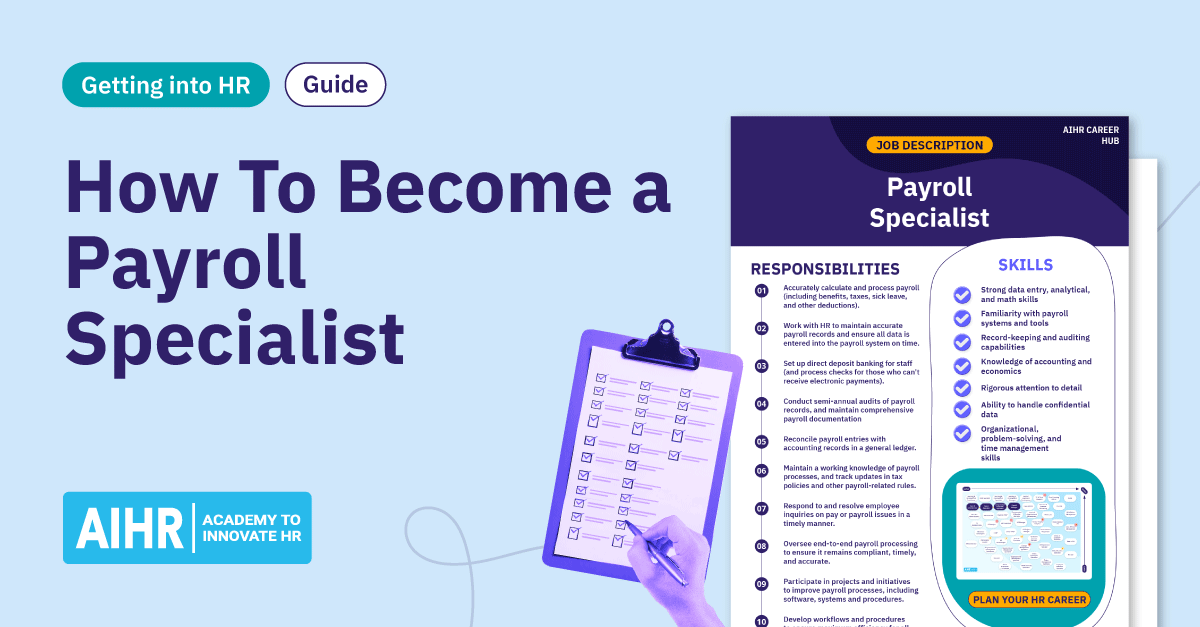

Payroll Specialist job description

A Payroll Specialist is essential to any organization. They oversee payroll processing (both electronic and paper), maintain and audit payroll records to ensure accuracy, stay current on payroll laws and tax guidelines, and handle all employee questions related to pay and deductions. This helps improve employee satisfaction and build trust in the organization.

Roles and responsibilities of a Payroll Specialist

Here are the roles and responsibilities of a Payroll Specialist:

- Accurately calculate and process payroll (including benefits, taxes, sick leave, and other deductions)

- Work with HR to maintain accurate payroll records and ensure all data is entered into the payroll system on time

- Set up direct deposit banking for staff (and process checks for those who can’t receive electronic payments)

- Conduct semi‑annual audits of payroll records and maintain comprehensive payroll documentation

- Reconcile payroll entries with accounting records in a general ledger

- Maintain a working knowledge of payroll processes and track updates in tax policies and other payroll-related rules

- Respond to and resolve employee inquiries on pay or payroll issues in a timely manner

- Oversee end-to-end payroll processing to ensure it remains compliant, timely, and accurate

- Participate in projects and initiatives to improve payroll processes, including software, systems, and procedures

- Develop workflows and procedures to ensure maximum efficiency for all payroll processes.

HR tip

51% of organizations still claim to use spreadsheets and manual processes to process payroll, while just 4% currently use AI, and only 8% have plans to implement it. However, one of the most notable pain points in payroll processing is repetitive activities, which AI could help reduce.

AI in payroll can facilitate pattern recognition, anomaly detection, and identify trends, while AI chatbots can respond to common payroll queries and reduce repetitive, manual tasks for Payroll Administrators and Specialists.

Qualifications for a Payroll Specialist role

To succeed as a Payroll Specialist, candidates need the right mix of education, certifications, and experience.

Educational requirements

Here are the minimum educational requirements for becoming a Payroll Specialist in the U.S.:

- High school diploma or GED certificate (minimum requirement)

- Bachelor’s degree in accounting, finance, HR, or a related field (preferred by many employers)

Recommended certifications

Although optional, relevant certifications within the Payroll Specialist field can help advance your career. Here are some popular certifications:

- Fundamental Payroll Certification (FPC): This certification is offered to entry-level payroll specialist candidates who can demonstrate their knowledge and proficiency in payroll fundamentals.

- Certified Payroll Professional (CPP): The American Payroll Association (APA) offers this to payroll specialists with a minimum of 18 months’ work experience in a payroll position, and who have completed multiple payroll practices and concepts courses.

Work experience

While organizations and industries vary, here’s the experience you will generally need to be considered for a Payroll Specialist job:

- Entry-level roles may require one to three years of payroll or administrative experience, as a payroll clerk or specialist

- Larger companies may prefer more experience.

Master payroll to improve the employee experience

To optimize the employee experience and boost your employer brand, you must ensure payroll is accurate, timely, compliant, and integrated with other HR processes.

✅ Understand the payroll approaches that influence your payroll process

✅ Learn how to create an efficient payroll schedule for your organization

✅ Use real-life examples and case studies to prepare for payroll admin challenges

✅ Obtain skills valuable for advancing to senior payroll or HR roles

Learn at your own pace with the online HR Generalist Certificate Program.

Skills and competencies for a Payroll Specialist role

Let’s explore the specific skills and competencies required of a Payroll Specialist.

Technical skills

- Strong data entry, analytical, and math skills for payroll accuracy and analyzation

- Familiarity with payroll systems and tools (e.g., spreadsheet software and payroll databases, including Microsoft Excel and Google Sheets)

- Record-keeping and auditing capabilities

- Knowledge of accounting, economics, and other relevant financial concepts.

Soft skills

- Rigorous attention to detail to ensure fast and precise data entry and processing, and spot errors and discrepancies

- Trustworthiness and ability to handle confidential data

- Clear verbal and written communication to answer employee queries and explain processes

- Time management skills to process payroll in a timely manner and multitask, all while maintaining a healthy work-life balance

- Self-motivation and organizational skills to manage workload and meet deadlines

- Problem-solving skills to find solutions to common payroll problems, and escalate them to the manager level when necessary

- The ability to work both independently and as part of a team.

HR tip

Some of the most commonly used payroll software includes ADP, QuickBooks, VLOOKUP, Oracle Payroll, OnPay, Paychex, Rippling, Gusto, and Square Payroll. Many of these software companies offer free trials and can integrate seamlessly with your existing HR tech stack.

Average Payroll Specialist salary

Let’s examine a Payroll Specialist’s average salary in the U.S.

According to Indeed, the average base salary for a Payroll Specialist in the U.S. is $42,836 per year, with the lowest recorded salary at $30,385 and the highest at $60,388. According to Salary.com, they earn an average yearly salary of $58,927, with salaries ranging from $47,743 to $70,263.

Glassdoor, on the other hand, reports a significantly higher average salary in the U.S. at $65,974. It’s important to note that compensation varies depending on experience, skills, qualifications, company size, location, and industry.

AIHR certificate programs to take

AIHR offers two self-paced online programs to help Payroll Specialists strengthen technical and strategic skills.

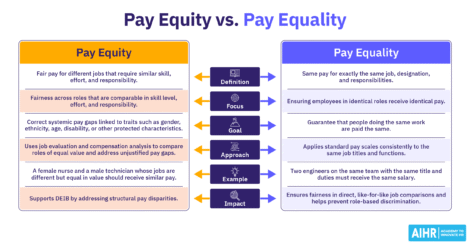

Compensation & Benefits Certificate Program

The Compensation & Benefits Certificate Program covers total rewards strategy, job evaluation, pay equity, and sales compensation structures. Projects include linking total rewards to company objectives, budgeting pay cycles, benchmarking analysis, and designing sales pay structures.

HR Metrics & Dashboarding Certificate Program

The HR Metrics & Dashboarding Certificate Program will help you build skills in HR metrics, data analysis, and dashboard design in Excel, Power BI, and Tableau. Participants learn to align HR metrics with business goals and communicate data through clear reporting and storytelling.

HR tip

Payroll skills shortages are intensifying. ADP’s Potential of Payroll report found:

- 57% say payroll is affected by staff shortages

- 67% are training non-payroll staff in payroll tasks

- 79% are upskilling existing payroll staff.

By gaining certifications, analytics skills, and AI knowledge, Payroll Specialists can stand out and add more value to organizations.

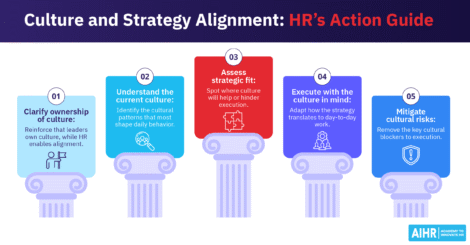

Career paths for a Payroll Specialist

Payroll Specialists have several options for career progression, depending on their interests and strengths. One common route starts with moving from the Payroll Administrator role to the Payroll Specialist role, and then advancing into Compensation and Benefits Specialist before stepping into a leadership position such as Payroll Manager.

Another pathway begins in broader HR roles like HR Coordinator or Benefits Administrator before specializing in payroll and advancing to C&B management. A third option is to grow from an HR Administrator into a Payroll Specialist role, then transition into Compensation and Benefits — with the potential to move up to Compensation and Benefits Manager.

Each of these paths builds on payroll expertise while opening doors to broader HR and compensation responsibilities, offering professionals opportunities to develop both technical and strategic skills.

Next steps

Payroll Specialists play a central role in ensuring accuracy, compliance, and employee trust. To move forward, identify the skills you need to develop — whether it’s mastering payroll software, advancing into compensation and benefits, or building analytics expertise.

With the right education, certifications, and continuous learning, Payroll Specialists can move beyond day-to-day processing into strategic roles that shape workforce planning and business success.