Over 25% of workers cite pay mistakes as a reason to consider switching jobs, making the role of a Payroll Manager specialized and critical. From ensuring accurate, punctual salary payment to managing compliance and partnering with multiple departments, they play a key part in a company’s overall business operations.

This article explores what being a Payroll Manager entails, the qualifications, skills, and experience you’ll need to become one, and possible career progression before and after you take on this role.

Contents

What is a Payroll Manager?

Payroll Manager job description

Qualifications for a Payroll Manager role

Skills and competencies for a Payroll Manager role

Average Payroll Manager salary

KPIs for this role

Potential career path for a Payroll Manager

AIHR certificate programs to consider

Key takeaways

- A Payroll Manager owns payroll operations, and must ensure accuracy, timeliness, and compliance.

- Core responsibilities include reconciling payroll, managing tax filings, audits, and having a backup plan if payroll systems are down.

- Common KPIs include payroll accuracy rate, timeliness, resolution time, compliance violations, and process improvement metrics.

- A Payroll Manager may go on to become Senior Payroll Manager, Director of Payroll/Compensation, HR Operations leadership, or specialize in global payroll or compensation.

What is a Payroll Manager?

A Payroll Manager is responsible not just for correct and punctual pay, but also for the appropriate handling of deductions, benefits, and taxes. Additionally, they own end-to-end payroll, bridge HR, finance, and IT to keep employee data in sync, align pay cycles with accounting, and ensure system integrations run smoothly.

Maintaining compliance, clear audit trails, and strong controls is another key component of the role. Depending on company size, they may lead a team of specialists or work hands-on with calculations and vendors. They are the primary contact for questions on payroll and for external stakeholders (e.g., payroll providers, tax authorities, auditors, and benefits vendors).

Payroll Manager job description

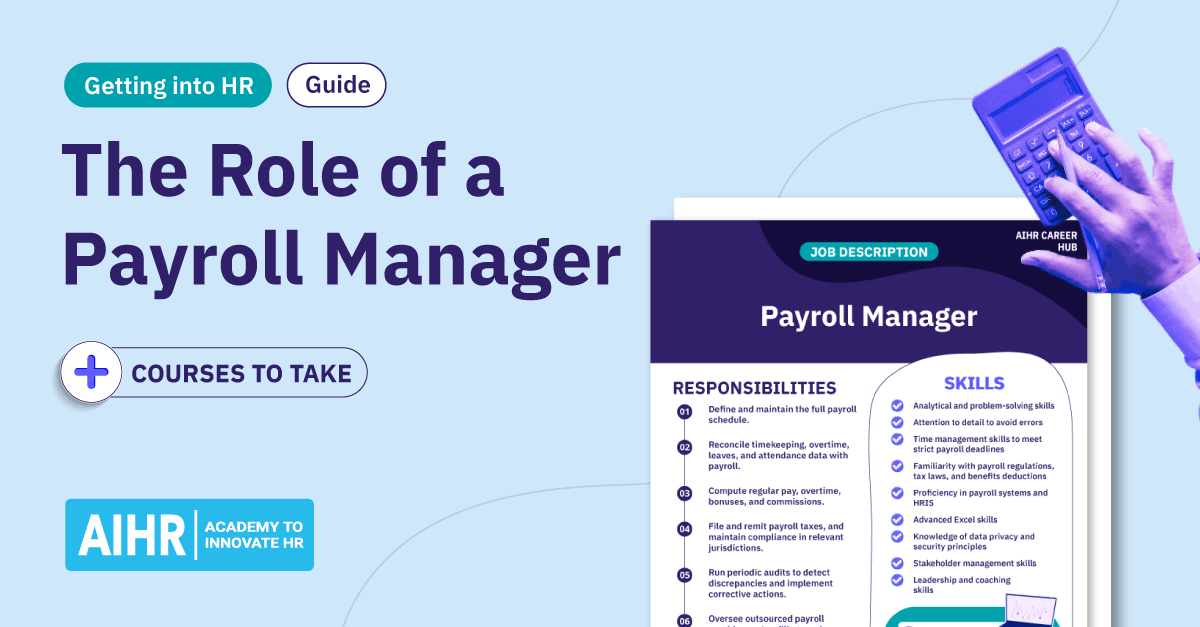

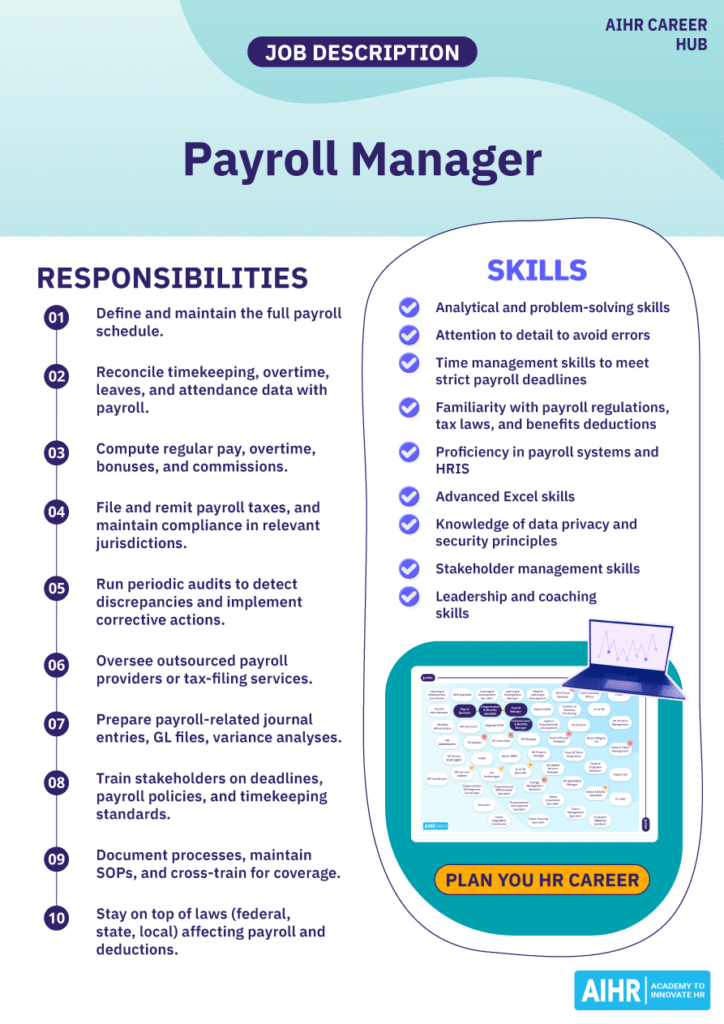

Roles and responsibilities of a Payroll Manager

Here are the roles and responsibilities of a Payroll Manager:

- Define and maintain the full payroll schedule (pre-payroll checks, input deadlines, sign-off dates, and post-payroll reconciliation).

- Coordinate with HR and time/attendance systems for accurate cutoffs.

- Import or validate HR data (new hires, terminations, promotions, allowances, etc.).

- Reconcile timekeeping, overtime, leaves, and attendance data to payroll.

- Compute regular pay, overtime, bonuses, and commissions.

- Apply statutory and voluntary deductions.

- File and remit payroll taxes, maintain compliance in all relevant jurisdictions.

- Handle year-end tasks, like W-2s/1099s, reconciliation, and tax authority responses.

- Design and enforce controls (e.g., duties and approval workflows).

- Run periodic audits to detect discrepancies and implement corrective actions.

- Ensure benefits deductions are processed correctly.

- Handle court-ordered garnishments (e.g., child support, levy, wage attachments) in accordance with legal requirements.

- Oversee outsourced payroll providers or tax-filing services.

- Negotiate SLAs, monitor vendor deliverables, and ensure data security.

- Prepare payroll-related journal entries, GL files, and variance analyses.

- Support internal and external audits, providing documentation and explanations.

- Respond to inquiries from employees or managers.

- Train stakeholders on deadlines, payroll policies, and timekeeping standards.

- Have a backup process in case payroll systems are down.

- Document processes, maintain SOPs, and cross-train for coverage.

- Stay on top of laws (federal, state, local) affecting payroll and deductions.

- Update system configurations/procedures if laws, benefits, or internal policies change.

Build the skills you need to be an efficient Payroll Manager

To be an efficient Payroll Manager, you must master end-to-end payroll, enforce compliance, lead with clarity, partner across HR/finance/IT, and communicate calmly under pressure.

✅ Understand the payroll approaches that influence your payroll process

✅ Learn how to create an efficient payroll schedule for your organization

✅ Use real-life examples and case studies to prepare for payroll admin challenges

✅ Obtain skills valuable for advancing to senior payroll or HR roles

Learn at your own pace with the online HR Generalist Certificate Program.

Qualifications for a Payroll Manager role

Here’s what many organizations look for in a Payroll Manager:

Educational requirements

- Bachelor’s in accounting, finance, business, HR, or a related field

- Equivalent experience in full payroll operations may substitute for formal schooling

- Advanced credentials or graduate studies may help in complex or global payroll environments, but are not always required.

Recommended certifications

Although optional, relevant certifications for the Payroll Manager position can help boost your résumé. Here are some popular certifications:

- Fundamental Payroll Certification (FPC): Also from PAYO, the FPC confirms solid payroll fundamentals, helps newcomers or cross-functional staff build confidence, and strengthens eligibility for entry-level payroll roles.

- Certified Payroll Professional (CPP): Offered by PayrollOrg (PAYO), the CPP validates advanced payroll expertise and boosts credibility for leadership roles.

Work experience

- Typically, three to five years or more of payroll experience, ideally with full ownership of a payroll cycle.

- Experience in multi-state or international payroll is a plus.

- Demonstrated background in supervising staff or managing vendor relationships is preferred.

Skills and competencies for a Payroll Manager role

A strong Payroll Manager must have a combination of relevant technical and leadership skills. Below are the key competencies you need to succeed in this role:

Role-specific skills

- Attention to detail: Precision and accuracy in payroll tasks to avoid errors.

- Time management: Ability to meet strict payroll deadlines.

- Analytical skills: Capability to review payroll data and identify trends or discrepancies.

- Problem-solving: Ability to resolve payroll-related issues efficiently.

Technical skills

- Familiarity with payroll regulations, tax laws, federal/state/local rules, and benefits deductions.

- Proficiency in payroll systems and HRIS, including handling imports, exports, mapping, and interfaces (time systems, benefits).

- Advanced Excel skills (formulas, pivot tables, lookup functions, reconciliation).

- Familiarity with data privacy and security principles, including access controls and audit logging.

Soft skills

- Clear, timely communication: With employees, finance, leadership, and vendors.

- Stakeholder management: Balancing demands from HR, finance, IT, and leadership.

- Calmness under pressure: To keep operations running smoothly during stressful payroll “crunch time”.

- Leadership and coaching: The ability to mentor, delegate, set priorities, and develop capabilities is crucial for those managing a team.

HR tip

If you’re interviewing a Payroll Manager candidate, ask them to walk you through how they’d resolve a pay discrepancy for an employee (e.g., missing overtime hours) and how they’d document it. Their answer will show not just the extent of their technical skill, but also their process discipline and communication approach.

Average Payroll Manager salary

Compensation for Payroll Managers varies by location, organizational complexity (e.g., multi-state or international operations), scope (headcount, transaction volume, and regulatory load), systems, and experience.

Indeed lists an average annual base salary of $91,010, while Salary.com estimates an average yearly Payroll Manager salary of $111,496 per year. Glassdoor, on the other hand, indicates this figure as $126,613.

KPIs for this role

- Timely and accurate payroll: Payroll accuracy rate, percentage of on-time pay runs, and average resolution time for payroll issues.

- Compliance: Number of compliance audits passed, compliance violations resolved, and legal claims or fines related to payroll.

- Employee satisfaction: Employee satisfaction scores, number of payroll-related complaints, and resolution time for issues.

- Process improvement: Number of improvements implemented, error reduction percentage, and reduction in processing time.

- Cost control: Total payroll processing costs, cost per transaction, and reduction in processing costs.

- Team management: Employee retention rate, team productivity, and engagement scores.

Potential career path for a Payroll Manager

A common career path starts in execution-heavy roles like Payroll Specialist, where you learn core processes, systems, and compliance. From there, many become C&B Specialists to build breadth in pay design, deductions, and benefits administration. They may then step up to Payroll Manager to lead cycles, vendors, and cross-functional work with HR and finance.

From here, you can advance into a C&B Manager role, taking on broader rewards strategy and governance. Lateral moves are also possible — you can become an HR Generalist or Regional HR Business Partner (HRBP) if you want greater people ops exposure and business partnering experience before returning to senior payroll or total rewards leadership.

For other relevant career paths, check out AIHR’s HR Career Map, which allows you to plan your career path regardless of your level of HR experience or seniority.

AIHR certificate programs to consider

Here are specific AIHR certificate programs that align well with Payroll Managers’ needs, why each is relevant, and at which stages of your career they may be most useful.

HR Generalist Certificate Program

The HR Generalist Certificate Program equips you with a broad understanding of core HR processes, including payroll administration and contract management. It helps you align HR policies with business objectives, improve operational efficiency, and better address employee queries related to payroll and benefits.

Compensation & Benefits Certificate Program

The Compensation & Benefits Certificate Program deepens your expertise in areas such as pay principles, job evaluation, benchmarking, and rewards structures. This allows you to participate in strategic compensation discussions, ensure legal and policy compliance, and design effective payroll schedules. It also provides practical resources and analytics skills.

HR Manager Certificate Program

The HR Manager Certificate Program helps you develop strategic decision-making skills, drive impactful HR strategies, and foster team management capabilities. It will prepare you to transition from operational tasks to influencing organizational HR policies, leading teams, and aligning payroll functions with overall business strategy.

Next steps

Start by auditing your current payroll function, then flag gaps like. Assess your own skills, pick one or two areas to build over the next three to six months, and choose targeted learning with a clear timeline. Additionally, define three to five KPIs you will own, and strengthen your external awareness by networking with peers and attending webinars.

Following this plan will make your payroll operation tighter, faster, and more compliant, while increasing your credibility with finance and HR leadership. It also positions you for the next step in your career, whether that’s leading broader HR operations or moving into total rewards leadership.