It’s understandable why the role of Benefits Specialist is anticipated to grow in the next 10 years. A tightening labor pool and intense competition for skilled workers have created a talent war where organizations need to offer more than just a paycheck. In fact, 70% of U.S. employees view benefits as a key factor when accepting a job, up from 57% in 2017.

Benefits Specialists play a crucial role in attracting and retaining top talent in a competitive job market. If this is a career path that interests you, read on to get to grips with the A-Z of this important role.

Contents

What is a Benefits Specialist?

Compensation and Benefits Specialist job description

Roles and responsibilities of a Benefits Specialist

Qualifications for the Compensation and Benefits Specialist role

Skills and competencies for a Benefits Specialist role

Average Compensation and Benefits Specialist salary

KPIs for this role

Potential career path of a Benefits Specialist

AIHR certificate programs to consider

Key takeaways

- The role of Benefits Specialist is crucial for organizations to attract and retain top talent amidst a competitive job market.

- Benefits Specialists manage employee benefits packages, ensuring compliance with laws and regulations while enhancing employee satisfaction.

- Key responsibilities include benefits administration, strategic planning, vendor management, and effective communication with employees.

- To become a Benefits Specialist, candidates typically need a relevant degree, work experience in benefits administration, and HR certifications.

- The average salary for a Compensation and Benefits Specialist ranges from $88,000 to $109,000, varying by location and industry.

What is a Benefits Specialist?

A Benefits Specialist, also known as a Compensation and Benefits Specialist, plans and administers your organization’s employee benefits package. Their core mission is to ensure that your benefits are competitive, compliant, and, importantly, genuinely valued by your employees, which directly impacts talent attraction, engagement, and retention.

This also means that the Benefits Specialist is both a planner and an administrator. Their work involves designing and continuously improving employee benefits, from health and dental to retirement and paid leave.

This includes extensive work in benchmarking plans against the market, participating in salary and compensation surveys, and advising HR Business Partners (HRBPs) and managers on the best benefit choices to meet the business’s and employees’ needs.

Compensation and Benefits Specialists also manage the day-to-day benefits operations. This includes overseeing team enrollment and eligibility processes, handling administrative tasks related to vendor billing, producing accurate reports, and maintaining clean, auditable benefits data.

Importantly, Benefits Specialists must also be internal compliance experts, ensuring adherence to all laws and regulations that impact benefits. They keep auditable records and proactively update processes as rules change.

They also act as a liaison with external vendors, such as insurers, brokers, and third-party administrators (TPAs), as well as internal HR, Payroll, and Finance teams to deliver cost-effective, high-quality benefits for your employees.

Compensation and Benefits Specialist job description

The role of a C&B Specialist blends strategic planning aspects with detailed administration. Their primary goal is to develop and maintain a comprehensive total rewards package that is fair, competitive, and compliant with all applicable laws.

So, what are the key focus areas for this position? Here is a high-level snapshot of the core responsibilities found in a typical Benefits Specialist job description:

Core program administration and compliance

- Administer and improve existing health, retirement (401k and pensions), family and medical leave (FMLA), and sick leave, and employee wellbeing programs.

- Keep plans compliant with all federal, state, and local regulations, including the Affordable Care Act (ACA), the Employee Retirement Income Security Act (ERISA), and the Health Insurance Portability and Accountability Act (HIPAA). This includes preparing all necessary filings, disclosures, and documentation.

- Maintain benefits systems to ensure data integrity, strong process controls, and the security of your sensitive employee information.

- Manage vendor and service-level relationships with all benefits providers, including brokers, carriers, and TPAs. These responsibilities include overseeing accurate data exchanges with the HRIS/payroll system.

Strategy and reporting

- Benchmark benefits and salary data against the external market and recommend plan design or policy changes to ensure your organization remains competitive in the broader talent market.

- Produce regular reports on plan costs, enrollment figures, and budget forecasts for leadership.

- Track key performance indicators (KPIs), such as plan participation rates, overall cost trends, and employee benefit satisfaction survey results, to drive continuous improvement.

Employee support and communication

- Educate your employees and managers through clear, comprehensive materials (presentations, employee handbook, intranet, online bots, etc) on their benefit options, the enrollment periods, and any plan changes.

- Handle complex employee inquiries and escalations related to benefits eligibility, claims, or coverage, to deliver clear, timely, and empathetic communication – particularly when it comes to health and family leave-related matters.

Roles and responsibilities of a Benefits Specialist

Let’s break down the Benefits Specialist responsibilities into three major areas: daily administration, strategic influence, and cross-functional management.

Day-to-day operations and administration

A Benefits Specialist oversees the full scope of benefits administration, managing employee enrollments, life-event changes, ongoing enrollment activities, and terminations. They are responsible for billing and reconciliation processes, comparing vendor invoices with internal payroll data to ensure all deductions and payments are accurate.

Another core part of the role involves maintaining benefits data within HRIS and benefits platforms, conducting regular audits to correct discrepancies, and ensuring compliance with legal reporting requirements and internal policies. As regulations evolve, the Benefits Specialist updates procedures to ensure compliance with all applicable federal, state, and local laws affecting employee benefits.

Strategic contribution and plan design

Beyond daily operations, the Benefits Specialist provides essential data and insights that help the organization shape a competitive benefits strategy. They conduct market benchmarking by participating in benefits and salary surveys, evaluating plan competitiveness, and analyzing employee participation to identify potential gaps.

They also contribute to plan design by working with brokers and carriers, preparing data-driven recommendations, and developing business cases for plan updates or new offerings. Additionally, they produce regular reports for leadership, tracking participation rates, cost per employee, and claims trends, to inform future planning and budgeting decisions.

Cross-functional and vendor management

Because benefits touch many areas of the business, the Benefits Specialist collaborates closely with several internal teams. They work with Payroll to ensure accurate deduction processing and with Finance on budgeting, accruals, and required financial reporting.

Vendor management is another key responsibility, including monitoring SLAs, overseeing eligibility and file feeds, and ensuring timely resolution of issues. Within HR, they partner with HR Business Partners and Talent Acquisition to align benefits offerings with the company’s total rewards philosophy and to support recruitment and retention goals.

They also play a critical role in employee education, providing clear written materials, leading information sessions, and offering individualized guidance to employees seeking support.

Future-proof your HR career with in-demand C&B skills

Stand out as a data-savvy, strategic HR professional who can design fair, competitive, and future-proof total rewards programs.

🎓 In AIHR’s Compensation & Benefits Certificate Program, you’ll learn how to:

✅ Build and evaluate Total Rewards Strategies tailored to business goals

✅ Conduct pay benchmarking and leverage C&B analytics for real business impact

✅ Design job grading structures and manage international compensation

✅ Analyze and address pay gaps using real-world data and frameworks

Qualifications for the Compensation and Benefits Specialist role

To become a Benefits Specialist, you can pursue formal education; however, organizations often value practical experience and specialized knowledge even more highly. Let’s unpack what qualifications you may need:

Educational foundation

The starting point today for most roles involves a relevant degree or equivalent experience, such as:

- A Bachelor’s degree in Human Resources, Business Administration, Finance, or a related field.

- Some organizations may accept several years of equivalent benefits experience as a substitute for a formal degree.

Work experience

A Compensation and Benefits Specialist needs hands-on experience dealing with the complexities of benefits plans:

- Typically three to seven years of experience in C&B or dedicated benefits administration.

- Demonstrated experience with hands-on process ownership, meaning you’ve managed key benefits processes (such as open enrollment or a benefits plan redesign) from start to finish.

- Additional experience and specialized certifications are usually preferred for senior roles or those with a multi-jurisdiction scope.

HR certifications

Adding specialized HR training to your resumé signals your commitment and mastery of complex regulations and strategy. Here are a few programs to consider:

- AIHR’s Compensation & Benefits Certificate Program focuses on building a strategic, data-driven foundation in total rewards management, enabling professionals to design competitive compensation packages that attract and retain top talent.

- Certified Employee Benefit Specialist (CEBS), offered by the International Foundation of Employee Benefit Plans (IFEBP). With US and Canadian options, CEBS provides a comprehensive program that integrates modules from Group Benefits Associate (GBA) and Retirement Plans Associate (RPA) curricula.

- AIHR’s Digital HR 2.0 Certificate Program helps specialists leverage technology and automation to streamline benefits administration and reporting processes, driving employee satisfaction and generating insights.

Skills and competencies for a Benefits Specialist role

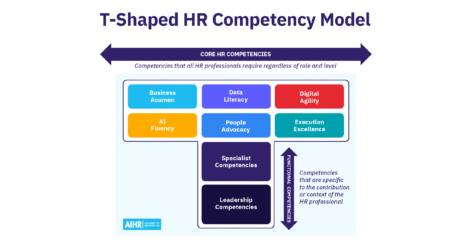

A successful Compensation and Benefits Specialist possesses a combination of strategic planning skills, technical proficiency in HR systems, and strong soft skills to manage complex relationships and communicate effectively with the workforce.

Role-specific skills

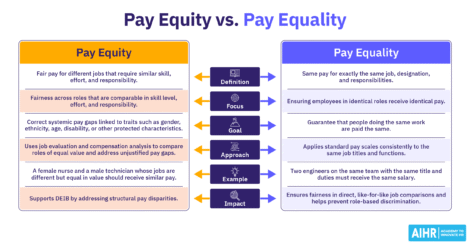

- Market benchmarking and plan evaluation: The ability to conduct rigorous trend analysis and comparative studies helps to ensure that your benefit plans are competitively positioned within the broader talent market.

- Benefits program design and improvement: Translating organizational business goals (such as employee wellness and high engagement) into a practical, cost-effective benefit program design that works within budget constraints.

- Annual cycle management: Diligent execution of core annual processes, including successful vendor renewals and rate negotiations, and smooth management of the high-volume, deadline-driven open enrollment period.

Technical skills

- Regulatory knowledge: Up-to-date and thorough knowledge of all relevant laws and regulations (e.g., ERISA, ACA, HIPAA, COBRA) that impact benefits. This also includes understanding how to apply compliance rules to all daily operational procedures.

- HRIS & data proficiency: Familiarity with Human Resources Information Systems (HRIS) and benefits administration platforms, along with a rigorous reporting discipline and focus on data integrity.

- Interface management: Familiarity with vendor portals, the management of EDI (Electronic Data Interchange) files or flat file feeds, as well as payroll interfaces. Advanced proficiency in Microsoft Excel is also essential for audit, analysis, and reconciliation work.

Soft skills

- Service-oriented communication: The ability to communicate clearly, professionally, and empathetically with employees, managers, and external vendors.

- Translational communication: Explaining complex benefit plan details, legal documents, and cost implications in simple, plain language that employees of all levels can easily understand.

- Organization and time management: Exceptional organization skills and the ability to juggle deadlines across renewals, open enrolment season, and audits.

- Cross-functional collaboration: A strength in cross-functional collaboration and business acumen to align benefit offerings with broader organizational talent strategy and cost management objectives.

Average Compensation and Benefits Specialist salary

The Compensation and Benefits Specialist is a mid-career position that is currently in very high demand in the US.

According to Revelio Labs data that informs AIHR’s Career Map, the median annual wage for this role typically falls between $88,000 and $109,000. These figures are based on comprehensive, aggregated workforce data that tracks real-time labor market trends.

Factors such as geographic location, industry, and the seniority of the role will influence this salary range.

KPIs for this role

- Accurate salary and benefits data: Ensure that all salary and benefits data are accurate and up-to-date to facilitate the smooth functioning of the organization’s compensation and benefits programs.

- Competitive compensation packages: Design and implement competitive compensation packages that attract and retain top talent.

- Compliance with legal requirements: Stay up-to-date and compliant with legal and regulatory requirements related to compensation and benefits.

- Cost-effective C&B programs: Manage compensation and benefits programs in a cost-effective manner.

- Timely reporting: Timely reporting of compensation and benefits data to senior management, finance, and other stakeholders for decision-making and planning.

- Effective communication: Communicate effectively with employees to ensure they understand and value the company’s compensation and benefits (C&B) programs.

- Continuous improvement: Constantly look for ways to improve compensation and benefits programs, such as through benchmarking against industry standards and best practices.

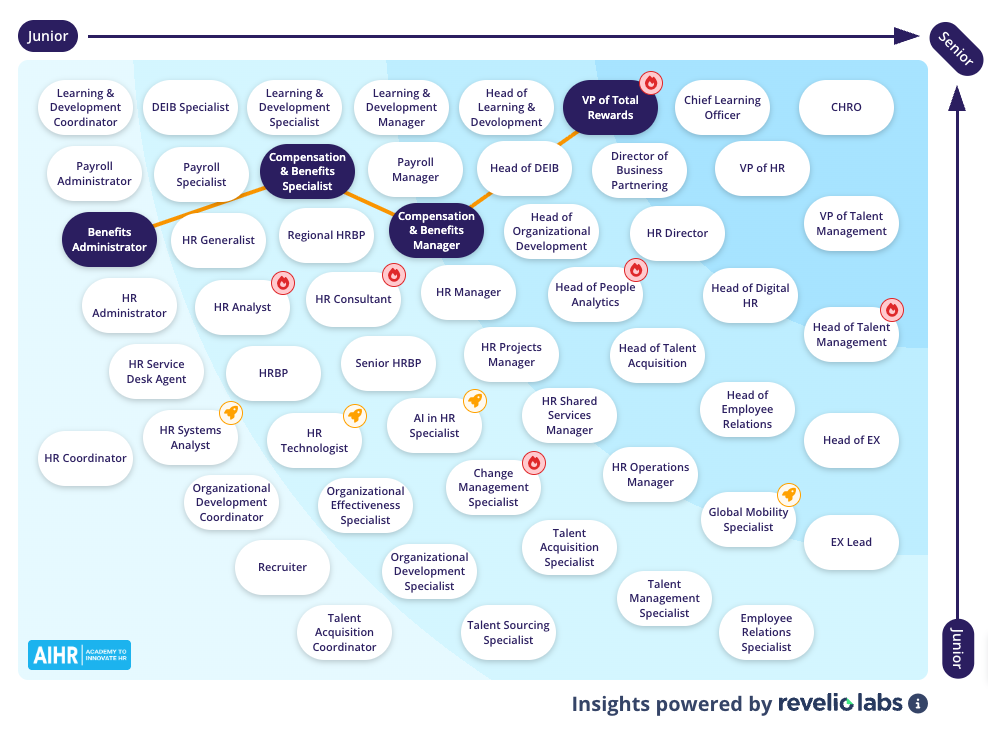

Potential career path of a Benefits Specialist

A career in Compensation and Benefits is a good fit if you are highly analytical and enjoy seeing your work directly impact employee wellbeing.

Using AIHR’s Career Map, you’ll see that the path typically progresses from administrative oversight to strategic management, with increasing complexity, budget responsibility, and global applicability as the position expands in scope and seniority.

The typical career trajectory

The natural progression within the benefits stream usually looks like this:

- Benefits Specialist (or Compensation & Benefits Specialist)

- Takes ownership of the entire benefits lifecycle from enrollment to compliance. This role combines administrative tasks with strategic responsibilities, including market benchmarking, vendor management, and supporting plan renewals.

- Average pay (US): $88,000 to $109,000 per year.

- Compensation and Benefits Manager

- Compensation and Benefits Managers oversee the strategic design, budgeting, and implementation of total rewards programs, encompassing both compensation and benefits, for a business unit or the entire company. Often responsible for managing a small team or regional programs.

- Average pay (US): $120,000 to $211,000 per year.

Senior and executive roles

From the Manager level, specialists can branch out into senior leadership or become deep subject matter experts:

- Director of Total Rewards: This executive-level role owns the global strategy for compensation, benefits, and wellbeing, and typically reports directly to the Vice President of HR or Chief HR Officer.

- Benefits Consultant: Transitioning to the consulting side, advising multiple client organizations on plan design, compliance, and cost optimization.

Moving up from management into senior executive roles requires shifting from transactional skills, such as data entry and processing, to strategic skills that include vendor negotiation, financial modelling, and risk management.

AIHR certificate programs to consider

If you’re looking to advance your expertise in Benefits or pivot from a Generalist role to an HR Consultant role, specialized certifications are invaluable. These AIHR programs help build the competencies needed for strategic impact and connect theory to practical, data-driven execution:

- Compensation & Benefits Certificate Program: This globally accredited and recognized certificate program builds strategic acumen and analytical skills by teaching you to design a total rewards strategy, conduct competitive market benchmarking, understand the various facets of compensation design, perform pay equity analyses, and ensure legal compliance.

This online program comprises 40 hours of training material and can be completed in 12 weeks. - Digital HR 2.0 Certificate Program: The future of HR is digital, making this program essential for leading transformation projects. It provides strong change management and technological fluency skills by focusing on design thinking to improve the employee experience; analyzing, optimizing, and automating key HR processes for increased efficiency and reduced errors; and driving digital adoption in your organization.

This online program is self-paced and comprises 36 hours of training material, typically completed within 12 weeks.

Next steps

Ready to up-level your career and take on the challenges of the Benefits Specialist role?

- Check out AIHR’s Career Map to plot your trajectory to plan a future-proof and lucrative career

- Sign up for AIHR’s Compensation & Benefits Certificate Program and get certified.

- Use the Benefits Specialist role as a stepping stone to a Compensation and Benefits Manager position.