What is straight time pay?

Straight time pay is the regular wage an employee receives during a standard pay period (e.g., 40 hours a week) for working regular hours at their standard rate. Generally, it does not include additional earnings, like bonuses, paid time off (PTO), or overtime pay.

In this case, any hour worked beyond 40 hours a week is considered overtime, which is calculated differently (i.e., time and a half). HR professionals must ensure straight time pay complies with state and federal labor laws so their organization follows fair labor practices.

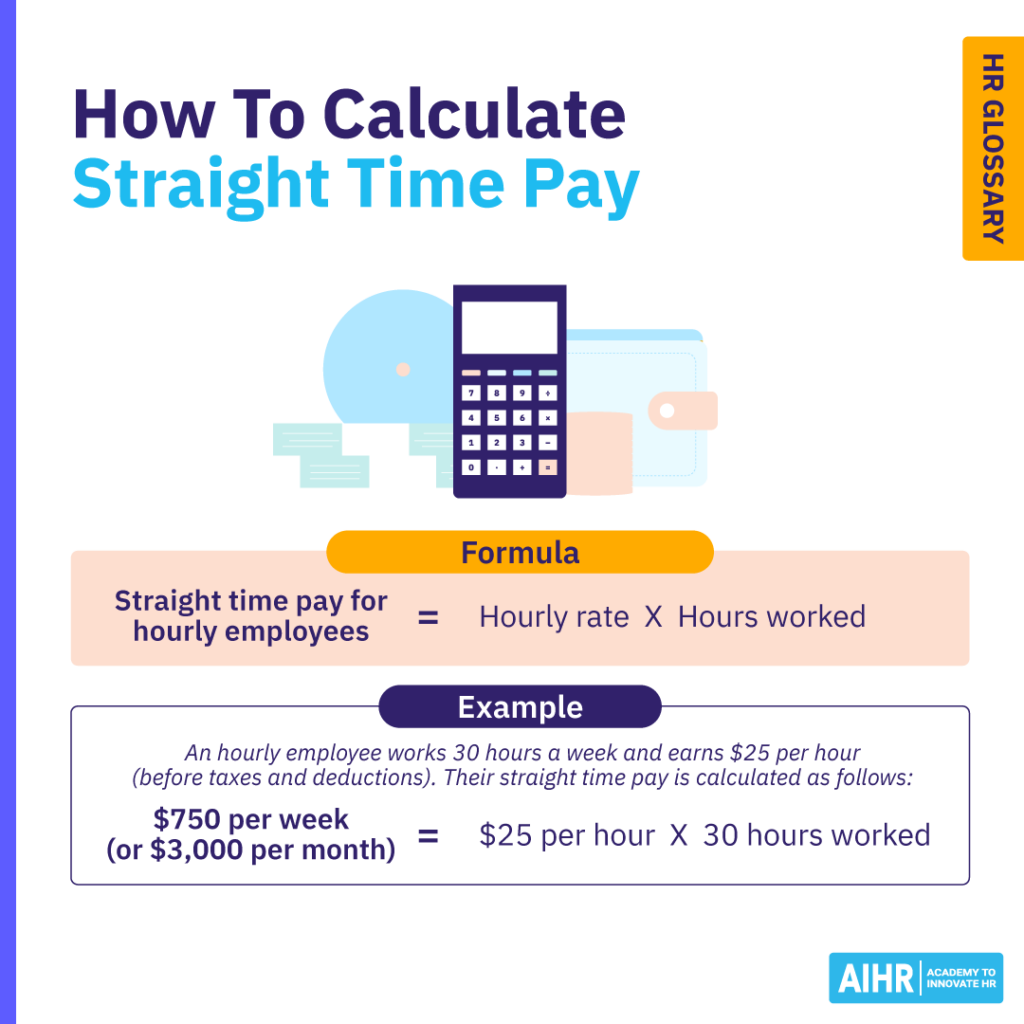

How to calculate straight time pay

For hourly employees

Calculating straight time pay is fairly simple. For an hourly employee, the formula involves calculating the total number of hours in a given pay period multiplied by the hourly rate.

| Straight time pay = | Hourly rate × Hours worked |

For example, an employee working 30 hours a week at $25 per hour would earn:

$25 hourly rate x 30 hours worked = $750 per week (or $3,000 per month)

For salaried employees

For a salaried employee, the straight time pay formula involves dividing the annual salary by 52 weeks (or the number of pay periods in a year).

| Straight time pay = | Annual salary | |

| Total cost of recruitment | ||

For instance, an employee who earns a gross salary of $65,000 per year would receive:

$65,000 annual salary ÷ 52 weeks = $1,250 per week (or $5,416.67 per month)

Straight time pay vs. overtime pay

The difference between straight time pay and overtime pay lies in how they are calculated and when they apply.

Definition

Compensation for regular working hours at a set rate.

Compensation for extra hours worked beyond standard work week hours.

Eligibility

Applies to both exempt employees and nonexempt employees.

Only nonexempt employees in the U.S. are entitled to overtime pay.

Pay rate

Employees’ standard rate.

1.5 times the standard hourly rate (or higher).

Calculation

- Hourly employee: Hourly wage × hours worked.

- Salaried employee: Annual salary ÷ 52 weeks (or number of pay periods in a year).

Hourly wage × 1.5 (or higher) × overtime hours worked.

Legal requirements

Must meet minimum wage requirements set by federal and state laws.

FLSA mandates overtime pay at a minimum of 1.5 times the regular rate.

Straight time pay: Laws and regulations

Straight time pay rates must meet minimum wage requirements set by state and federal laws, including the U.S. Fair Labor Standards Act (FLSA).

The FLSA defines a standard workweek as 40 hours for the purpose of calculating overtime. Any hours worked beyond 40 hours a week (or over eight hours a day) should qualify nonexempt employees for overtime pay. For exempt employees, their straight time pay is their salary (rather than an hourly wage), and they are not entitled to overtime pay.

Learn to design fair, competitive incentive compensation plans

Develop the necessary skills to create fair, competitive, and sustainable compensation plans. You need to be adept at negotiation, data interpretation, and stakeholder management to achieve this.

AIHR’s Compensation and Benefits Certificate Program will teach you the skills you need to interpret data, identify compensation gaps, and align rewards, performance, and culture.

Factors that affect straight time pay

Keep in mind the following factors that may impact straight time pay, such as:

- Hourly wage or salary: The base pay rate the employer sets determines straight time earnings. Hourly employees have a fixed hourly rate, while salaried employees receive a set amount for a standard work period.

- Number of hours worked: Straight time pay covers up to 40 working hours a week. Any hours worked beyond this are considered eligible for overtime pay.

- Minimum wage laws: The federal minimum wage in the U.S. is $7.25 per hour, which employers must comply with when establishing straight time pay. However, states like Arizona, California, and New York have higher minimum wage rates.

- Breaks: Short breaks (e.g., coffee or rest breaks) are usually covered by straight time pay but not meal breaks, which are not considered part of working hours. However, some states may have different laws regarding breaks during work hours.

- Industry standards: In addition to federal and state laws, consider industry standards when setting hourly rates to ensure straight time earnings are attractive and competitive, especially in tight labor markets.

HR tip

The gap between employer and employee perception of straight time pay can be significant. You can help close this gap by measuring and analyzing employee sentiment on compensation. Use quantitative data (salary surveys) and qualitative methods (employee surveys) to detect low pay satisfaction in your organization. Monitoring BLS data can help you stay informed on market rates.

FAQ

Straight time pay is the compensation an employee receives for hours worked at their regular rate. It does not include extra earnings like overtime, paid time off, or bonuses.

Yes, straight time pay is legal for regular hours worked. However, non-exempt employees must receive overtime pay for hours over 40 per week.

It depends on the employee’s financial needs and work preferences. Overtime pay comes at a higher rate—at least 1.5 times the regular hourly wage—but isn’t always guaranteed. Straight time pay, on the other hand, offers steady, predictable income, which can make budgeting easier. Some employees prefer the stability of regular wages, while others value the opportunity to earn more through extra hours.