Mergers and acquisitions (M&A) remain among the most popular strategies for organizations seeking fast growth. Global M&A activity has recently exceeded $3.2 trillion, with notable consolidation in sectors such as artificial intelligence, pharmaceuticals, and financial services. Organizations pursue M&A to acquire new capabilities, expand client bases, or strengthen their competitive position in saturated markets.

Yet despite their prevalence, M&As are notoriously risky. The Post-Merger Integration Survey by Eight Advisory found that 71% of transactions were perceived as strategically and financially successful, but only 40% achieved or exceeded expected synergies. Similarly, EY reported that nearly half of employees leave within the first year of a merger, highlighting the human cost of poorly managed integrations.

For HR leaders, this presents both a challenge and an opportunity. Beyond the financial and legal mechanics of the deal, HR plays a decisive role in ensuring employees, culture, and leadership come together to realize the intended value.

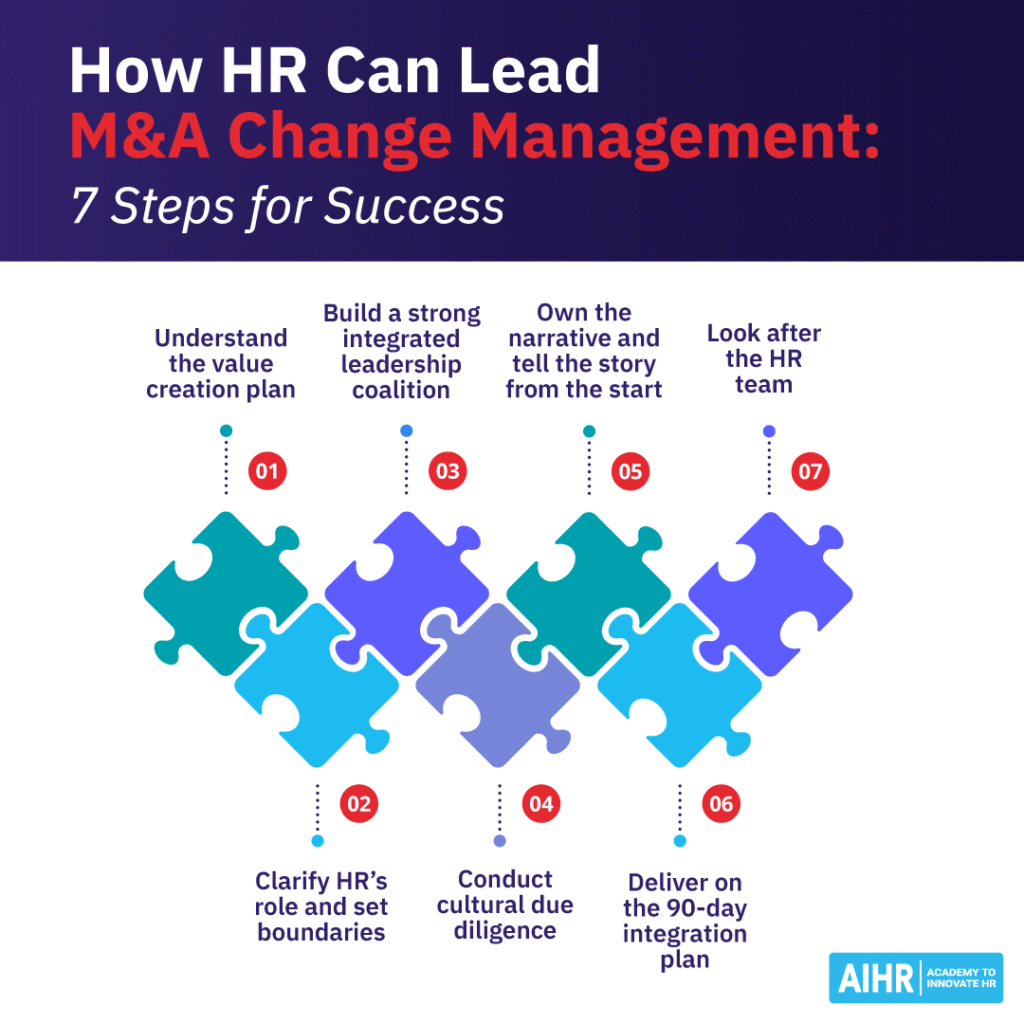

This article explores the role of HR in navigating M&A change management and highlights seven critical success factors.

Contents

The HR role in mergers and acquisitions

What HR needs to get right in M&A change management

The HR role in mergers and acquisitions

While many HR professionals see their role in M&A as focused mainly on managing the people side of change, like communications, engagement, and culture, the reality is that HR’s involvement should start much earlier and extend across every stage of the deal.

That involvement begins with understanding the type of transaction taking place. Mergers involve combining two or more companies into a new entity, while acquisitions refer to one company purchasing and integrating another. These differences are essential as they set the tone for the integration and transition.

Organizations pursue M&A for a variety of reasons:

- Growth acceleration: Expanding market share or entering new markets quickly.

- Economies of scale: Driving efficiency and cost reductions through consolidation.

- Risk mitigation: Diversifying across geographies or industries.

- Talent and capabilities: Acquiring specialized expertise, technology, or intellectual property.

- Competitive advantage: Consolidating market position or disrupting through innovation.

However, many employees do not experience M&A as an opportunity but as a time of disruption, uncertainty, and loss. Fear of job loss and uncertainty about leadership changes and culture can cause employees to become disengaged. As a result, key talent is at a higher risk of leaving during M&A.

We discussed the role of HR in mergers & acquisitions with Andrew Bartlow, HR leader and Founder of People Leader Accelerator. Watch the full interview below:

Before M&A

Before the deal closes, HR focuses on due diligence and planning. This involves thoroughly auditing the target company’s HR policies, employee contracts, and benefits to identify potential risks and liabilities. HR also conducts cultural assessments to gauge how well the two organizations will fit together. Where possible, HR teams should also be involved in workforce analysis to better understand each organization’s critical talent and skills and how they can be leveraged in the future.

I think maybe the greatest misconception is that a lot of people think it’s mostly about the mechanics, like making payroll work, getting everybody onto one system, harmonizing benefits. Day one communications often pop to mind. There’s often an ops-centered focus versus a culture-oriented focus. And I’d suggest that there’s actually a different focus area that might be more important, and that is value creation. What is the logic for that transaction? Why are these companies coming together? Are you trying to increase distribution? Are you trying to reduce costs through corporate synergies?

During M&A

As the deal unfolds, HR leads the transition and communication effort. The responsibility during this phase stretches beyond these activities. It should also include ensuring that the new entity has a clear strategy, that work on an integrated operating model and organizational design is taking place, and managing governance and compliance requirements related to the transition. Depending on the nature of the deal, this could extend to consolidating contracts and terms or further negotiations with unions and bargaining councils.

Post M&A

After the merger, HR’s focus shifts to integration and alignment. Here, they work to blend the two company cultures into one cohesive identity, which is a significant factor in the merger’s long-term success. Additionally, HR monitors employee morale and engagement, ensuring the new workforce is motivated and aligned with the company’s strategic goals.

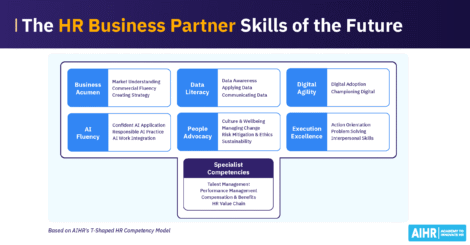

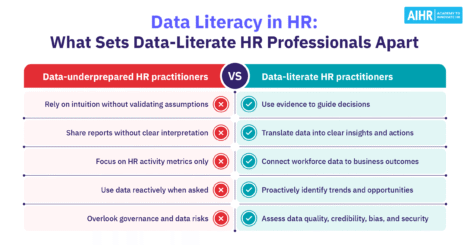

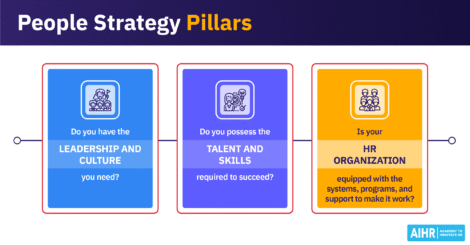

During organizational transformation, HR plays a central role in guiding people, aligning initiatives, and supporting business continuity. To be effective, your team needs strong data literacy, strategic thinking, and the ability to navigate change with clarity.

With AIHR for Business, your HR team will:

✅ Approach organizational change with a structured, strategic outlook

✅ Develop data literacy to support informed, evidence-based decisions

✅ Align people initiatives with evolving business priorities

✅ Develop data literacy to support informed, evidence-based decisions

🎯 Lead transformation with an HR team that is skilled, strategic, and future-ready.

What HR needs to get right in M&A change management

Managing change during a merger or acquisition is one of HR professionals’ most complex challenges. They need to guide employees through uncertainty, aligning cultures, and building trust in a new direction.

Beyond the formalized HR responsibilities above, there are specific critical success factors that HR needs to ensure are in place to drive value throughout and beyond the merger process.

1. Understand the value creation plan

The most common mistake in M&A is assuming employees automatically understand why the deal is happening and what value the organization aims to realize.

Understanding the value creation plan and the business case outlining how the deal will create financial, operational, or strategic value is non-negotiable for HR. Without it, HR cannot prioritize initiatives or tailor communications effectively. If the agreement aims to capture talent and innovation, retention of key experts must become the top HR priority. If cost savings are central, workforce restructuring must be managed transparently and fairly.

The value creation plan also serves as a great starting point for aligning a leadership coalition responsible for leading the integration efforts.

2. Clarify HR’s role and set boundaries

During M&A integration, HR often becomes the default owner of all people-related work. While HR should lead on the people strategy, it is important to define what that includes and what it doesn’t.

Set clear boundaries across functions early. HR is responsible for designing frameworks, supporting leaders, and keeping alignment on track. Day-to-day change management within teams should remain with people managers. HR can guide and support, but cannot take on every task tied to the transition.

Be cautious about falling into the role of being the person that everybody complains to. Focus more on the value creation and drive clarity and decision-making. Even if you’re not the decision-maker, you can highlight the benefits of providing more clarity faster.

3. Build a strong integrated leadership coalition

Integration success hinges on leadership alignment. When leaders from both organizations present conflicting messages, employees quickly lose trust. HR’s role is to help shape a unified leadership coalition that represents both legacy organizations and speaks with a single voice.

This can sometimes be problematic if specific leaders exit the organization as part of the deal. In these instances, it is essential to be clear about these leaders’ expectations and create clarity on their roles during the integration process.

Where possible, it is beneficial to have representation of different entities on an integrated leadership steering committee that will guide the transition. Importantly, you need to set the expectation that this leadership team might not be the final leadership team for the new integrated business. Still, they have been put in place specifically to guide the transition.

Illustrative example

A retail business had acquired two smaller players to diversify its product suite. All three CEOs formed part of the integrated steering committee responsible for guiding the transition for the first six months after the deal. Once the organizational design work had been completed, one CEO exited the business, while the other moved into a different role in the new structure.

It’s really important that there are conversations with the senior leadership team and key members of the staff of the acquired organization.

HR is best positioned to do that. The investing team is having those conversations as well, but it’s really helpful to have a professional who’s thinking about org structure, org design, org effectiveness, to speak with the humans, understand what their expectations are, ask them what their recommendations are to support the value creation efforts.

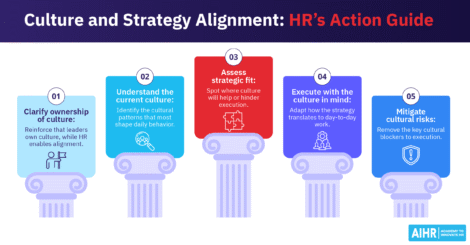

4. Conduct cultural due diligence

While financial due diligence is standard, cultural due diligence is often underestimated. 67% of executives have reported that cultural alignment and change management were the most underestimated issues during integrations. Mercer’s Culture Risk in M&A study similarly found that around 30% of transactions fail to meet financial targets due to cultural misalignment, with 67% experiencing delays in synergy realization.

Cultural due diligence involves assessing leadership styles, decision-making processes, and employee engagement before the deal closes. By identifying cultural differences and disconnects early, HR can craft integration strategies that bridge differences and prioritize culture work as part of the integration process.

For example, Microsoft’s acquisition of LinkedIn succeeded partly because leaders preserved LinkedIn’s autonomy in areas critical to its culture, while aligning operational practices. This balance prevented the culture clash that has derailed other high-profile mergers.

5. Own the narrative and tell the story from the start

In the absence of clear communication, rumors dominate. Employees report feeling less involved in decisions and goal alignment and becoming demotivated during the M&A process, highlighting a need for frequent and consistent two-way communication.

HR must proactively own the narrative, crafting a story that connects the deal rationale with employee concerns. This means addressing questions about job security, career opportunities, and culture. Importantly, communication should be two-way: employees need safe channels to ask questions and express concerns.

Example from practice

An insurance business that had bought one of its biggest competitors embarked on a national communication campaign, with key leadership members visiting all the various branches and highlighting the reason for the acquisition, the value to be realized, and the process that will guide the transition.

In the absence of clarity, we humans tend to jump to the worst conclusions. We have all sorts of fears and anxiety spin up.

So fill the void, drive the message, own the message, and be proactive about all the questions that are likely circulating in people’s heads, which again are likely to steer towards negative outcomes. So provide clear, definitive messaging as soon as you can. If you don’t have an answer on something yet, acknowledge the issue and provide updates along the way.

6. Deliver on the 90-day integration plan

The first 90 days post-close are critical. To achieve quick gains, it is good practice to set up an integration steering committee focusing on specific high-priority items that must be completed during the first 90 days after the deal’s announcement. Some of these could include:

- Strategy integration work: Setting a short-term strategy to continue with business as usual before finalizing the long-term strategy.

- Client consolidation: Ensuring that clients are transitioned to the new business in a meaningful way.

- Technology consolidation: Aligning different systems across the various companies to ensure an integrated way of working going forward.

- Organizational design: Clarifying structures, reporting lines, and role expectations quickly.

- Cultural initiatives: Integration workshops, joint onboarding sessions, and symbolic rituals that build a shared identity.

- Communication: Ensuring clarity and continuous communication to bring employees along the journey.

7. Look after the HR team

HR teams often face heavy workloads, emotional strain, and role uncertainty during M&A processes. If their needs are overlooked, it limits the HR’s capacity to support others, making it essential to actively protect their wellbeing throughout the process.

HR leaders should aim to create certainty for the team as quickly as possible, be transparent about what they can communicate, and guide the team in staggered priorities aligned to the available capacity.

Final words

The future of mergers and acquisitions is becoming more digital, data-driven, and global. HR leaders must be ready for virtual integrations, AI-supported cultural assessments, and cross-border compliance in increasingly complex regulatory environments.

To lead effective M&A change management, HR must be involved early, act strategically, and stay aligned with the organization’s value creation goals. When done well, HR can turn a complex, high-risk initiative into a structured process that delivers lasting impact.